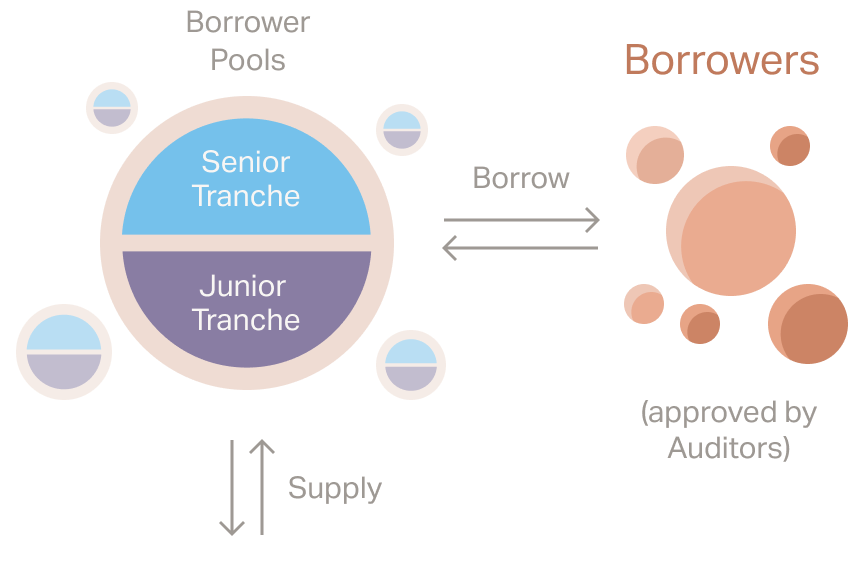

200k+ borrowers and growing

The protocol is already serving thousands of borrowers across the world, include India, Mexico, USA, Spain, Central Europe, Africa, Southeast Asia among others.

By decentralizing the process, DeFi can unlock an entirely new layer of underwriting capacity by allowing anyone to be a lender, not just banks..

Claim MSOL Now